(DO NOT READ IF YOU PLAN TO READ ATLAS SHRUGGED.)

For the record, I started Atlas Shrugged back in November, before the internet was filled with studies documenting the positive correlation between sales of the book and the state of the economy. I started the recent bandwagon, I did not hop on it.

I had returned from a beach vacation and decided that I needed to read something other than Vince Flynn and John Grisham. I don't mind reading trash from time-to-time, but I needed to read something substantial. Somehow I settled on Atlas Shrugged, not really knowing what to expect.

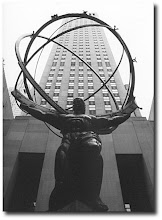

The story is about how seemingly innocent changes to an economy, made with the best intentions, will inevitably lead to its downfall. The only thing that survives are the principles and values held close by a few industrialists, entrepreneurs and thinkers. In theory, economies should perform better when left to their own devices. The state of the economy in the book begins crumbling the moment the Unification Board starts interfering. In an attempt to increase equality, the Board distorts incentives to such a degree that the country grinds to a halt.

Overall I really enjoyed the book. I was surprised to find that I already viewed the world in a similar fashion to Rand: I'm big on self-sufficiency, staying true to one's beliefs and the ideals of laissez-faire.

My timing could not have been better. As the powers that be in the book slowly started regulating everything, talk of 'bad banks' and Government Motors (GM) became more and more prevalent. The parallels were uncanny. So far, the real has yet to spiral to the depths that the fictional US does, but we may be on our way.

The book is huge, literally and figuratively. She fully succeeds in getting her point across. It's powerful. It resonates.

Wikipedia has a good entry here, a discussion of themes and symbols is here and a recent piece comparing the book to the world we are currently in is here.

31.3.09

29.3.09

Nursery Rhyme Bailout

Old Obama has several banks

Trilli-illy-o

And in these banks there were bad assets

Trilli-illy-o

With some MtM here

And a writedown there

Here a loss, there a loss

Everywhere a loss-loss

Old Obama has several banks

Trilli-illy-o

Old Obama has a few mortgages

Ree-ee-ee-ee-set

And now these mortgages are not affordable

For or or close

With a for-sale sign here

And a for-sale sign there

Here a sign, there a sign

Everywhere a sign-sign

Old Obama has few mortgages

Ree-ee-ee-ee-set

Old Obama has a FED

Print some more money

And with this money go to the mall

Speh-eh-eh-end

With some more debt here

And some job losses there

Here some debt, there some losses

Everywhere some debt-loss

Old Obama has a FED

I-i-i-i-flation

Trilli-illy-o

And in these banks there were bad assets

Trilli-illy-o

With some MtM here

And a writedown there

Here a loss, there a loss

Everywhere a loss-loss

Old Obama has several banks

Trilli-illy-o

Old Obama has a few mortgages

Ree-ee-ee-ee-set

And now these mortgages are not affordable

For or or close

With a for-sale sign here

And a for-sale sign there

Here a sign, there a sign

Everywhere a sign-sign

Old Obama has few mortgages

Ree-ee-ee-ee-set

Old Obama has a FED

Print some more money

And with this money go to the mall

Speh-eh-eh-end

With some more debt here

And some job losses there

Here some debt, there some losses

Everywhere some debt-loss

Old Obama has a FED

I-i-i-i-flation

I'm A Fan Of This Tax Increase

I'm not a big fan of taxes. I'd rather pay less than more. But this tax I like. I bear the brunt of smokers indirectly. I have to smell it and breath in smoke. And I have to pay their hospital bills through my taxes. Therefore, increasing the cost of this habit can not be a bad thing.

Hopefully, the extra revenue generated from an increased tobacco tax will remove the burden of their healthcare costs from me. I wonder how many people would smoke if they had to pay for their own care when they get lung cancer?

On the other hand, maybe I'm contradicting myself. People should be able to slowly kill themselves if they so choose. Who am I to say whether or not that's a good idea? But the other part of me just thinks: "tax the living daylights out of tobacco". And I think that's the part of that will win out.

Hopefully, the extra revenue generated from an increased tobacco tax will remove the burden of their healthcare costs from me. I wonder how many people would smoke if they had to pay for their own care when they get lung cancer?

On the other hand, maybe I'm contradicting myself. People should be able to slowly kill themselves if they so choose. Who am I to say whether or not that's a good idea? But the other part of me just thinks: "tax the living daylights out of tobacco". And I think that's the part of that will win out.

Labels:

Taxation

28.3.09

Good Piece From Rolling Stone

This stuck out:

He maintains a good balance between scathing sarcasm and simplifying complex events. A lot of time is spent mapping out the relationships of the current players: Paulson, Geithner and the guys who were/are running banks. It's a small world and everyone wants to help out their old friends.

The entire piece by Matt Taibbi can be found here.

As complex as all the finances are, the politics aren't hard to follow. By creating an urgent crisis that can only be solved by those fluent in a language too complex for ordinary people to understand, the Wall Street crowd has turned the vast majority of Americans into non-participants in their own political future. There is a reason it used to be a crime in the Confederate states to teach a slave to read: Literacy is power. In the age of the CDS and CDO, most of us are financial illiterates. By making an already too-complex economy even more complex, Wall Street has used the crisis to effect a historic, revolutionary change in our political system — transforming a democracy into a two-tiered state, one with plugged-in financial bureaucrats above and clueless customers below.

He maintains a good balance between scathing sarcasm and simplifying complex events. A lot of time is spent mapping out the relationships of the current players: Paulson, Geithner and the guys who were/are running banks. It's a small world and everyone wants to help out their old friends.

The entire piece by Matt Taibbi can be found here.

Labels:

AIG,

bailout,

banking,

Derivatives

27.3.09

FIrst Pass

Mini-Madoff, Canadian style [Bloomberg]

Ecuadorean oil cuts [IHT]

Surprise build in US nat gas stocks, sends price back down [Forbes]

Taleb's crusade rages on [Slate]

A scathing story about working at AIG [Clusterstock]

Ecuadorean oil cuts [IHT]

Surprise build in US nat gas stocks, sends price back down [Forbes]

Taleb's crusade rages on [Slate]

A scathing story about working at AIG [Clusterstock]

26.3.09

25.3.09

All of AIG Exposed

Apparently, the insurance side was into crazy derivatives as well. The whole company was making massive bets. This story just keeps getting better and better. I wonder what will happen next? One side of the company was selling complex, structured products to the other?

Labels:

AIG,

Derivatives

We're Out of the Woods

I think everything is fine now: U.S. economy shows new signs of life. Maybe everyone is spending their bonus money on TVs and fridges. We're all good. Phew, that was quick. I guess CNBC has been right all along. If we just stay bullish for long enough, everything will work it's way out.

(Just be sure and ignore anything that points to downward revisions in any data and don't read in to what exactly is making up the numbers. Just be greatly that they've got a '+' in front of them.)

(Just be sure and ignore anything that points to downward revisions in any data and don't read in to what exactly is making up the numbers. Just be greatly that they've got a '+' in front of them.)

Labels:

recesion

Cycling in Canada

I've been riding bikes for about 5 years, with the last 2 being quite serious. This year I decide to join a club and enter some races. It seems that cycling is one those sports you can't just participate in. In order to be legit, you must be on a team and be training for something specific. I could resist no longer so I joined the Speed Theory team.

We were supposed to ride a TT today because there are so many Cat 5's on the team and we need to rank them for training rides. However, since it's March and we're in Canada there is snow on the roads and it's below zero out. I think we managed one day of spring on Friday with temps in yhe 10's or so. Now the TT is postponed indefinitely and we're relegated back to riding indoors on our trainers.

You've got to be mentally tough to ride in Canada. The 6 months of winter are spent riding indoors watching horrible movies that never should have been made. The summers in southern Alberta are spent riding outside in a swirling head/tail wind that seems to follow you around. It's not easy battling the winds coming over the Rockies all the time. Just when I think it can't get any windier, I am proven wrong.

On Saturday, I was out with a buddy and the weather changed out of nowhere and we got slaughtered by a massive wind. It was so powerful that we were almost blown over riding up some hills. It got so cold that we stopped early and called in for rides home. My face was so frozen that I could barely talk. It was like I had been to the dentist. All in all it was an adventurous Saturday, but I would not knowingly go out in massive wind and plummeting temps again.

View Larger Map

We were supposed to ride a TT today because there are so many Cat 5's on the team and we need to rank them for training rides. However, since it's March and we're in Canada there is snow on the roads and it's below zero out. I think we managed one day of spring on Friday with temps in yhe 10's or so. Now the TT is postponed indefinitely and we're relegated back to riding indoors on our trainers.

You've got to be mentally tough to ride in Canada. The 6 months of winter are spent riding indoors watching horrible movies that never should have been made. The summers in southern Alberta are spent riding outside in a swirling head/tail wind that seems to follow you around. It's not easy battling the winds coming over the Rockies all the time. Just when I think it can't get any windier, I am proven wrong.

On Saturday, I was out with a buddy and the weather changed out of nowhere and we got slaughtered by a massive wind. It was so powerful that we were almost blown over riding up some hills. It got so cold that we stopped early and called in for rides home. My face was so frozen that I could barely talk. It was like I had been to the dentist. All in all it was an adventurous Saturday, but I would not knowingly go out in massive wind and plummeting temps again.

View Larger Map

Labels:

Cycling

24.3.09

Geithner Market

Thought I'd take a quick look at the implied odds of Geithner leaving office by June 2009. Volume has picked up recently and volatility looks to have increased as well.

It'll be interesting to follow this as his plan plays out.

It'll be interesting to follow this as his plan plays out.

Labels:

bank bailout,

Geithner

First Pass

Lance crashes in Spain; future races in doubt [cyclingnews]

Canada's banks are looking more and more liquid [portfolio.com]

A fantastic idea [clusterstock]

A very timely analogy explaining the most recent round of bailouts [econlog]

More on Geithner's 'plan' [self-evident]

I'm not a huge Alberto Contador fan, so it was nice to see this [velonews]

Canada's banks are looking more and more liquid [portfolio.com]

A fantastic idea [clusterstock]

A very timely analogy explaining the most recent round of bailouts [econlog]

More on Geithner's 'plan' [self-evident]

I'm not a huge Alberto Contador fan, so it was nice to see this [velonews]

23.3.09

First Pass

More US LNG in the summer [Oil and Gas Journal]

'Rumourtrage' [ftalphaville]

Large Canadian M&A [NYTimes]

Toxic asset plan, just in time [Bloomberg]

Part I of carry trade school [Zero Hedge]

'Rumourtrage' [ftalphaville]

Large Canadian M&A [NYTimes]

Toxic asset plan, just in time [Bloomberg]

Part I of carry trade school [Zero Hedge]

Labels:

Energy market,

fx,

market manipulation

20.3.09

First Pass

Ratings shmatings. Do credit ratings mean anything anymore? [Clusterstock]

US budget deficit balloons [Reuters]

Goldman profiting from AIG's collapse [Zero Hedge]

GS conference call regarding relationship with AIG [WSJ]

Surprising retail numbers in Canada [Report on Business]

Next year, I'm going to get Barclays to do my taxes [Guardian UK]

Just in case your Friday is going too well, read this [Daily Reckoning]

Give Bernanke a run for his money [San Francisco Fed]

US budget deficit balloons [Reuters]

Goldman profiting from AIG's collapse [Zero Hedge]

GS conference call regarding relationship with AIG [WSJ]

Surprising retail numbers in Canada [Report on Business]

Next year, I'm going to get Barclays to do my taxes [Guardian UK]

Just in case your Friday is going too well, read this [Daily Reckoning]

Give Bernanke a run for his money [San Francisco Fed]

19.3.09

First Pass

Quashing deflation fears in Canada [Report on Business]

The effects of quantitative easing in the US [Bloomberg]

Is this what brought LEH down? [Bloomberg]

Not according to this interview [Portfolio.com]

Changing status of the USD [ftalphaville]

It's not looking good for Geithner:

This is a graph from Intrade showing the probability that he will be out of job by by June 2009.

The effects of quantitative easing in the US [Bloomberg]

Is this what brought LEH down? [Bloomberg]

Not according to this interview [Portfolio.com]

Changing status of the USD [ftalphaville]

It's not looking good for Geithner:

This is a graph from Intrade showing the probability that he will be out of job by by June 2009.

17.3.09

First Pass

Do what this guy does [Clusterstock]

Interesting advice for AIG [Reuters]

A workaround for the gov to recoup the AIG bonus money [Dealbreaker]

Surprising housing numbers out of the US [Bloomberg]

Lance calls out his teammate [Cyclingnews]

Large decrease in worldwide upstream energy deals [Oil & Gas Journal]

Interesting advice for AIG [Reuters]

A workaround for the gov to recoup the AIG bonus money [Dealbreaker]

Surprising housing numbers out of the US [Bloomberg]

Lance calls out his teammate [Cyclingnews]

Large decrease in worldwide upstream energy deals [Oil & Gas Journal]

Labels:

Cycling,

economics,

Energy market,

recession

16.3.09

First Pass

Declining nat gas rigs in the US [Bloomberg]

A view on the eventual recovery [Econbrower]

Encouraging numbers from Canadian investors [Report on Business]

Not so encouraging Canadian housing numbers [Report on Business]

Interesting goings on at the weekend OPEC meeting [Oil and Gas Journal]

A view on the eventual recovery [Econbrower]

Encouraging numbers from Canadian investors [Report on Business]

Not so encouraging Canadian housing numbers [Report on Business]

Interesting goings on at the weekend OPEC meeting [Oil and Gas Journal]

Labels:

economics,

Energy market,

recession

15.3.09

First Pass

AIG just can not stay out of the news. Now, there are publicizing their counterparties who are getting bailout money and their bonus program is coming under harsh criticism. [Bloomberg]

This gets a little technical, but it is a good explanation of credit spreads, CDSs and broader view of the industry. [A Credit Trader]

Canadian growth will not be in line with the Bank of Canada's most recent estimate. [Report on Business]

An unexpected move by OPEC. [Bloomberg]

This gets a little technical, but it is a good explanation of credit spreads, CDSs and broader view of the industry. [A Credit Trader]

Canadian growth will not be in line with the Bank of Canada's most recent estimate. [Report on Business]

An unexpected move by OPEC. [Bloomberg]

Labels:

bailout,

Derivatives,

recession

14.3.09

13.3.09

Mixed Bag

I read Madoff's allocution the other and was immediately struck by the fact that he deposited large sums of cash into accounts at J.P. Morgan Chase. How did the bank not know that something was? Maybe they did... [Portfolio.com]

An interesting piece on magnesium bikes. My bike is a carbon fiber monocoque and I've heard of titanium bikes, but I've never heard of a magnesium bike [velonews.com]

I watched Cramer get trashed by Jon Stewart. Stewart did a good job of asking relevant questions and Cramer did a good job of not really answering them while at the same time admitting he may have made a mistake or two. I think CNBC is in a bad position. They can't decide whether or not they want to be an entertainment channel or a news channel. One could argue that they've managed a decent balancing act until now, but that their perceived position is changing.

It was easy to fly all over the world with the CEOs of various banks and go on rants about companies and yell at the government when the markets were going up. But ever since the market has gone down, CNBC is seen more as part of problem rather than an impartial entity reporting on the problem.

They would argue that in order to get the best stories they have to be tight with the Wall St. inner circle, that there is no other way and that this is part of the territory. Wall St. is run by insiders and so CNBC promotes and rallies behind the companies and people it wants to remain close to in order to maintain a competitive advantage over the other financial news organizations.

I can understand why Stewart thinks that CNBC contributed to the current financial mess. They were bullish up until the very last second and started up again as soon as they could. The part that bugs me, though, is that Stewart thinks that CNBC is responsible for the drop in his mother's retirement fund.

Why are investing and finance areas where it's ok to be ignorant? You don't drive a car with knowing the rules of the road, how to operate it and what the risks are. If you don't understand the risks involved, that's fine, just don't invest and instead, put all of your money into a savings account. If you do invest, you must be prepared that crazy stuff will happen. People must take responsibility for their actions. That is the key point. Everyone wants to be absolved of responsibility and play the blame game. Granted, derivatives got out of hand and everyone bet against them all being in the money at once. But, the probability isn't zero. It's larger than we'd initially think, but it's definitely not zero.

And don't give me some story about an investment professional telling you that your money would grow at 7% indefinitely and you just did what they said and now your portfolio is down 50%. You could have not invested. If you are shocked at being down 50% you should never have invested. No one forced you to. You did it because you got greedy just like the Wall St. CEO's that are taking all the heat (I am in no way defending what they did. They got super greedy and bet the farm without fully understanding the risks and that was stupid.).

You could have put your money under the mattress and not participated in any of the craziness.

An interesting piece on magnesium bikes. My bike is a carbon fiber monocoque and I've heard of titanium bikes, but I've never heard of a magnesium bike [velonews.com]

I watched Cramer get trashed by Jon Stewart. Stewart did a good job of asking relevant questions and Cramer did a good job of not really answering them while at the same time admitting he may have made a mistake or two. I think CNBC is in a bad position. They can't decide whether or not they want to be an entertainment channel or a news channel. One could argue that they've managed a decent balancing act until now, but that their perceived position is changing.

It was easy to fly all over the world with the CEOs of various banks and go on rants about companies and yell at the government when the markets were going up. But ever since the market has gone down, CNBC is seen more as part of problem rather than an impartial entity reporting on the problem.

They would argue that in order to get the best stories they have to be tight with the Wall St. inner circle, that there is no other way and that this is part of the territory. Wall St. is run by insiders and so CNBC promotes and rallies behind the companies and people it wants to remain close to in order to maintain a competitive advantage over the other financial news organizations.

I can understand why Stewart thinks that CNBC contributed to the current financial mess. They were bullish up until the very last second and started up again as soon as they could. The part that bugs me, though, is that Stewart thinks that CNBC is responsible for the drop in his mother's retirement fund.

Why are investing and finance areas where it's ok to be ignorant? You don't drive a car with knowing the rules of the road, how to operate it and what the risks are. If you don't understand the risks involved, that's fine, just don't invest and instead, put all of your money into a savings account. If you do invest, you must be prepared that crazy stuff will happen. People must take responsibility for their actions. That is the key point. Everyone wants to be absolved of responsibility and play the blame game. Granted, derivatives got out of hand and everyone bet against them all being in the money at once. But, the probability isn't zero. It's larger than we'd initially think, but it's definitely not zero.

And don't give me some story about an investment professional telling you that your money would grow at 7% indefinitely and you just did what they said and now your portfolio is down 50%. You could have not invested. If you are shocked at being down 50% you should never have invested. No one forced you to. You did it because you got greedy just like the Wall St. CEO's that are taking all the heat (I am in no way defending what they did. They got super greedy and bet the farm without fully understanding the risks and that was stupid.).

You could have put your money under the mattress and not participated in any of the craziness.

12.3.09

Required Reading

Madoff's allocution [Dealbreaker via WSJ]

Some perspective on large amounts of money [Gizmodo]

Canadian doom and gloom [Report on Business]

Some perspective on large amounts of money [Gizmodo]

Canadian doom and gloom [Report on Business]

11.3.09

First Pass

And again...Paulson & Co cleaning up the UK banking sector [ftalphaville]

A nice discussion of AIG, CDSs and moral hazard [Econbrowser]

More on moral hazard [CafeHayek]

John Galt would hate this bill [Report on Business]

Libor rate are indicating that credit markets are still frozen [Bloomberg]

A nice discussion of AIG, CDSs and moral hazard [Econbrowser]

More on moral hazard [CafeHayek]

John Galt would hate this bill [Report on Business]

Libor rate are indicating that credit markets are still frozen [Bloomberg]

Labels:

bailout,

economics,

Hedge funds

10.3.09

First Pass

The contango in the crude market is almost completely gone [ftalphaville]

Will crude follow nat gas on its march to zero? [clusterstock]

This does not bode well for consumer confidence [Reuters]

Hayek wrestling with the economy [Taking Hayek Seriously]

Will crude follow nat gas on its march to zero? [clusterstock]

This does not bode well for consumer confidence [Reuters]

Hayek wrestling with the economy [Taking Hayek Seriously]

Labels:

economics,

Energy market,

recession

9.3.09

First Pass

Built on fake [Dealbreaker.com]

C'mon man, you didn't have to go that far, did you? [Reuters.com]

Update on the crude contango, the WTI/Brent spread and the goings on with the USO [ftalphaville]

Paris-Nice is the first meaningful European stage race of the season. A lot of riders will begin gauging their competition for the grand tours at this race.

C'mon man, you didn't have to go that far, did you? [Reuters.com]

Update on the crude contango, the WTI/Brent spread and the goings on with the USO [ftalphaville]

Paris-Nice is the first meaningful European stage race of the season. A lot of riders will begin gauging their competition for the grand tours at this race.

Labels:

Cycling,

economics,

Energy market

7.3.09

6.3.09

First Pass

Black Swan hedge fund closing because they're are making too much money. [Bloomberg]

Rogue traders at MER before BOA bought em? [Bloomberg]

So timely. If you haven't read this yet, now's the perfect time. [Asymmetric Information]

More on BOA's lack of due diligence. [ftalphaville.com]

5.3.09

I Love CNBC Just As Much As The Next Guy

For some reason, Jon Stewart is not a fan. Rick Santelli was supposed to be on the Daily Show, but he "bailed out", so in fine form, Stewart tears in to the network.

Labels:

economics

4.3.09

Hedge Funds

Another good piece, here, from Bethany McLean on hedge funds. One thing that stood out was the fact that no hedge fund manager has asked for their industry to be bailed out.

Labels:

Hedge funds

Cycling Photos

Liz Kreutz has Tour of California photos here. Go to Index >> Lance's Comeback >> Tour of California.

Labels:

Cycling,

Tour of California

More Michael Lewis

I'm a fan of his pieces. This is his latest in Vanity Fair. He also had a good one, here, at Portfolio.com.

3.3.09

Quantitative Easing Vs. Open Market Operations

In the Bank of Canada's statement today, they mentioned that they were open to quantitative easing. I'd heard this phrase used by the Federal Reserve in the fall, but I hadn't really understood what it means or how it is different from open market operations.

Turns out, they are quite similar. When a central bank announces a change to the target of their benchmark rate they must either buy or sell government securities in the open market. In order to lower (raise) interest rates, the bank must buy (sell) government bonds in the open market. These transactions change the size of the money supply causing the benchmark rate to approach its target.

Quantitative easing involves purchasing a wider variety of securities or accepting securities as collateral for loans from the central bank. Both buying and lending increase the amount of money in circulation.

Remember all those mortgage backed securities and collateralized debt obligations that the US banks couldn't wait to get off of their balance sheets? The Federal Reserve will accept the best of these assets as collateral for loans in order to infuse the economy with more money.

A slightly more technical, but still accessible explanation is available here.

Turns out, they are quite similar. When a central bank announces a change to the target of their benchmark rate they must either buy or sell government securities in the open market. In order to lower (raise) interest rates, the bank must buy (sell) government bonds in the open market. These transactions change the size of the money supply causing the benchmark rate to approach its target.

Quantitative easing involves purchasing a wider variety of securities or accepting securities as collateral for loans from the central bank. Both buying and lending increase the amount of money in circulation.

Remember all those mortgage backed securities and collateralized debt obligations that the US banks couldn't wait to get off of their balance sheets? The Federal Reserve will accept the best of these assets as collateral for loans in order to infuse the economy with more money.

A slightly more technical, but still accessible explanation is available here.

Labels:

Central Banks,

economics

FIrst Pass

It's refreshing to see that someone had a good year. I guess with fewer players in the market it's easier to make a profit. [Bloomberg]

Low nat gas prices are trickling through and producers are beginning to shut-in. [Oil and Gas Journal]

Debt begets more debt. [The Australian]

Low nat gas prices are trickling through and producers are beginning to shut-in. [Oil and Gas Journal]

Debt begets more debt. [The Australian]

Canada Cuts

The Bank of Canada cut the benchmark overnight rate to 0.50%, the lowest it's ever been. The move was in line with expectations. Banks should cut the prime lending rate to 2.50%.

2.3.09

Large Hadron Collider

Ever wanted to inside a particle accelerator, but didn't have the requisite PhD in theoretical physics to get in? Here's your best shot.

Labels:

Science

Good Reads

Strange times in the crude market [FT Alphaville]

Interesting look at Wall Street bonuses being paid for with bailout money [Vanity Fair]

If you're looking for a car, I know a guy... [Clusterstock]

Interesting look at Wall Street bonuses being paid for with bailout money [Vanity Fair]

If you're looking for a car, I know a guy... [Clusterstock]

1.3.09

A Look Around

A big loss, matched with more gov cash at AIG. [Globe And Mail]

Sorry Eastern Europe, we've got our own issues. [WSJ]

Oooooh, and that's a bad miss. [Reuters]

Think Q4 Canadian GDP will be as bad as the US? [Bloomberg]

Sorry Eastern Europe, we've got our own issues. [WSJ]

Oooooh, and that's a bad miss. [Reuters]

Think Q4 Canadian GDP will be as bad as the US? [Bloomberg]

Subscribe to:

Comments (Atom)