28.4.09

25.4.09

23.4.09

Trading Strategy

SemGroup, a large US private equity company that went bankrupt last year, lost most of its money with a "No-Loss" trading strategy. Did they think that if they named it that, it would make money no matter what?

They lost piles of money as the price of oil made a big run and they were effectively short. There were also a few executives making shady moves and doubling down as positions began bleeding.

They lost piles of money as the price of oil made a big run and they were effectively short. There were also a few executives making shady moves and doubling down as positions began bleeding.

Labels:

Energy market,

trading

17.4.09

Accounting Is Sweet

Citi posted a gain because they can MtM the gain on their debts. So as their debts become less negative, they realize the change as a gain. Accounting is fun!

Labels:

Accounting

Crude Market

FTAlphaville has a couple interesting posts going over some factors currently affecting the WTI and the sour crude market. Contango, shipping costs, sweet vs. sour and OPEC are all discussed.

Start here and then here.

Start here and then here.

Labels:

Crude Market

Calculus Does Have A Role In The Real World

We have been keeping our eyes open for any negative second derivatives. Basically, when the second derivative is negative, the rate of recessionary decline is slowing. It is a first step towards capitulation and an eventual turn around.

14.4.09

That's A Bad Miss

Looks like Lehman could not get out of a uranium trade and now they are long physical uranium. They accepted delivery and now have a bunch of yellowcake. I guess now they are going to wait for the commodity markets to rebound before they sell the stuff. Nothing like trading commodities in an illiquid, heavily regulated market...

It raises so many questions: Have they talked to Iran or North Korea yet? What does storage cost? What is their cost of carry? When do they expect uranium demand to rebound? Who trades spot market yellowcake?

It raises so many questions: Have they talked to Iran or North Korea yet? What does storage cost? What is their cost of carry? When do they expect uranium demand to rebound? Who trades spot market yellowcake?

Labels:

commodity markets

5.4.09

Ugh

Lately, I've gotten tired of following all the developments in the de-capitalization of the capital markets. This bailout and that bailout. This promise and that promise. Those bonuses and whose bonuses? Everything is such a mess and it is going to take a while for it to be resolved. I'm tired of analogies putting the financial mess into terms even I can understand.

I'm suffering from negative-data-fatigue-syndrome or NDFS for short. It's exhausting being inundated with and having to process unemployment figures, growth figures, money supply changes, trade data, current account balances, consumer spending numbers and all the random indices that come out every week. And I'm an information fiend. I like to be on top of it. But, 'it' has gotten so big that I would have to leave my job in order to track 'it' to the extent that it deserves. But I can't leave my job cause there's a recession going on.

I have a high tolerance for information so I am used to handling a lot at once, but it is starting to get ridiculous. I would rather be smacking you with information instead of having it smack me. Ugh.

I'm suffering from negative-data-fatigue-syndrome or NDFS for short. It's exhausting being inundated with and having to process unemployment figures, growth figures, money supply changes, trade data, current account balances, consumer spending numbers and all the random indices that come out every week. And I'm an information fiend. I like to be on top of it. But, 'it' has gotten so big that I would have to leave my job in order to track 'it' to the extent that it deserves. But I can't leave my job cause there's a recession going on.

I have a high tolerance for information so I am used to handling a lot at once, but it is starting to get ridiculous. I would rather be smacking you with information instead of having it smack me. Ugh.

Labels:

bailout,

economics,

finance,

government intervention,

information

And On The 7th Day

I smoked a cigar. I paid off my student loans in full this week. I think all in it was 25k+ and took me 2.25 years. I never crunched the numbers to see if it would have been better to make the minimum payments and invest the remaining funds. I just wanted to be debt free as soon as possible.

So, this afternoon I got together with a couple of buddies from grad school to sit in the sun and smoke. Since it was a special occasion, I went with a Cohiba Esplindido. It is probably my favorite celebratory cigar. It's 7 by 47, which means it's 7inches (178mm) long and has a diameter of 47/64th of an inch (18.65mm).

It's very full flavoured and the flavour changes dramatically as it is smoked. (I must apologize that my vocabulary for describing cigars needs some work.) It's not a super strong cigar like a Partagas Series D and it's got a nice draw.

So, this afternoon I got together with a couple of buddies from grad school to sit in the sun and smoke. Since it was a special occasion, I went with a Cohiba Esplindido. It is probably my favorite celebratory cigar. It's 7 by 47, which means it's 7inches (178mm) long and has a diameter of 47/64th of an inch (18.65mm).

It's very full flavoured and the flavour changes dramatically as it is smoked. (I must apologize that my vocabulary for describing cigars needs some work.) It's not a super strong cigar like a Partagas Series D and it's got a nice draw.

Labels:

cigars

3.4.09

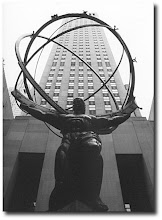

Star Wars vs Atlas Shrugged

When I was reading Atlas Shrugged and Dagny crashed her plane in Galt's Gulch,

I couldn't help but think of Lando Calrissian and his city in the clouds from Star Wars.

Hear me out because there are numerous similarities.

Both got fed up with the way society was working and decided to set up shop on the periphery and under their own terms. They are visionary men are are not handcuffed by the status quo. Both locations are only accessible through air travel and have a certain Utopian quality.

I couldn't help but think of Lando Calrissian and his city in the clouds from Star Wars.

Hear me out because there are numerous similarities.

Both got fed up with the way society was working and decided to set up shop on the periphery and under their own terms. They are visionary men are are not handcuffed by the status quo. Both locations are only accessible through air travel and have a certain Utopian quality.

Labels:

Atlas Shrugged

Economic Indicators

There's been a lot of talk about how to interpret all the economic releases that come out during the course of the week. Some looks promising, some not so much and some looks and good and bad depending on what kind of spin you put on.

The unemployment data that came out is bad. There is no way to put a good spin on it. None. In fact, I think the real unemployment rate is much higher. The current calculation does not include people who have stopped looking for work. Some argue that the actual rate is closer to two times larger than the headline rate of 8.6%.

I think it's difficult to come up a real number, but it is going to be higher than the headline rate for sure. I don't think the economy will turn around until we see these numbers decrease. The US job destruction is just massive and it will take time for job creation to ramp up.

The unemployment data that came out is bad. There is no way to put a good spin on it. None. In fact, I think the real unemployment rate is much higher. The current calculation does not include people who have stopped looking for work. Some argue that the actual rate is closer to two times larger than the headline rate of 8.6%.

I think it's difficult to come up a real number, but it is going to be higher than the headline rate for sure. I don't think the economy will turn around until we see these numbers decrease. The US job destruction is just massive and it will take time for job creation to ramp up.

Labels:

economics

Subscribe to:

Comments (Atom)